By Adrian Moise, CEO of Aequilibrium

Navigating the Forge Sunset: How Credit Unions Can Choose the Right Digital Banking Platform

With Forge sunsetting, credit unions across Canada find themselves at a pivotal crossroads. The decision ahead isn’t just about replacing technology, it’s about choosing a digital banking platform that can balance member expectations, operational resilience, and long-term strategic goals.

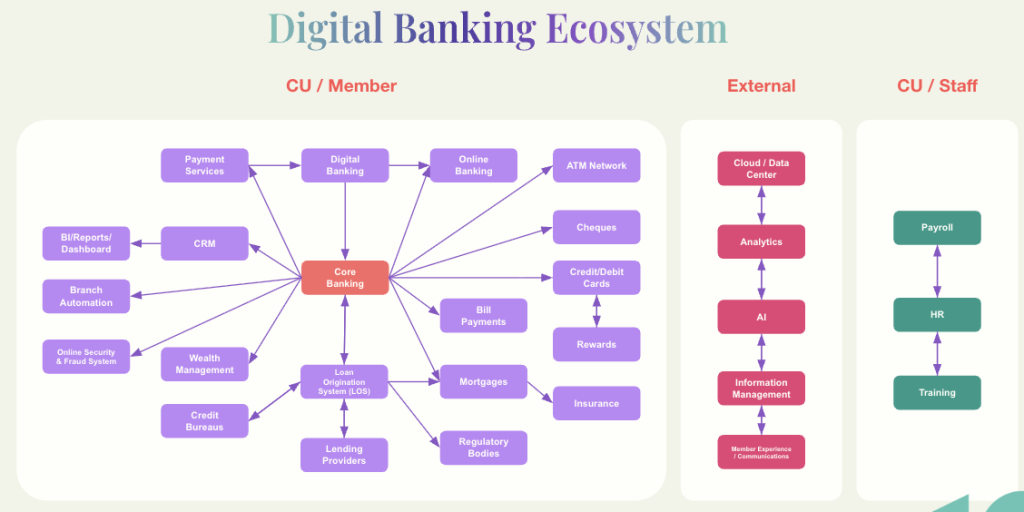

At Aequilibrium, we believe successful transformation requires more than just technology. It requires structure with empathy – a proven process that blends vision with execution, guided by four complementary perspectives we call the Four Lenses:

Business & Strategy – Adrian Moise, CEO

Experience – Daniel Paz, Senior Product Designer

Technology – Baris Tuncertan, Head of Technology

Governance & Delivery – Adrian and Baris together

Together, these perspectives ensure that every migration decision addresses the realities of operations while keeping members at the heart of the journey.

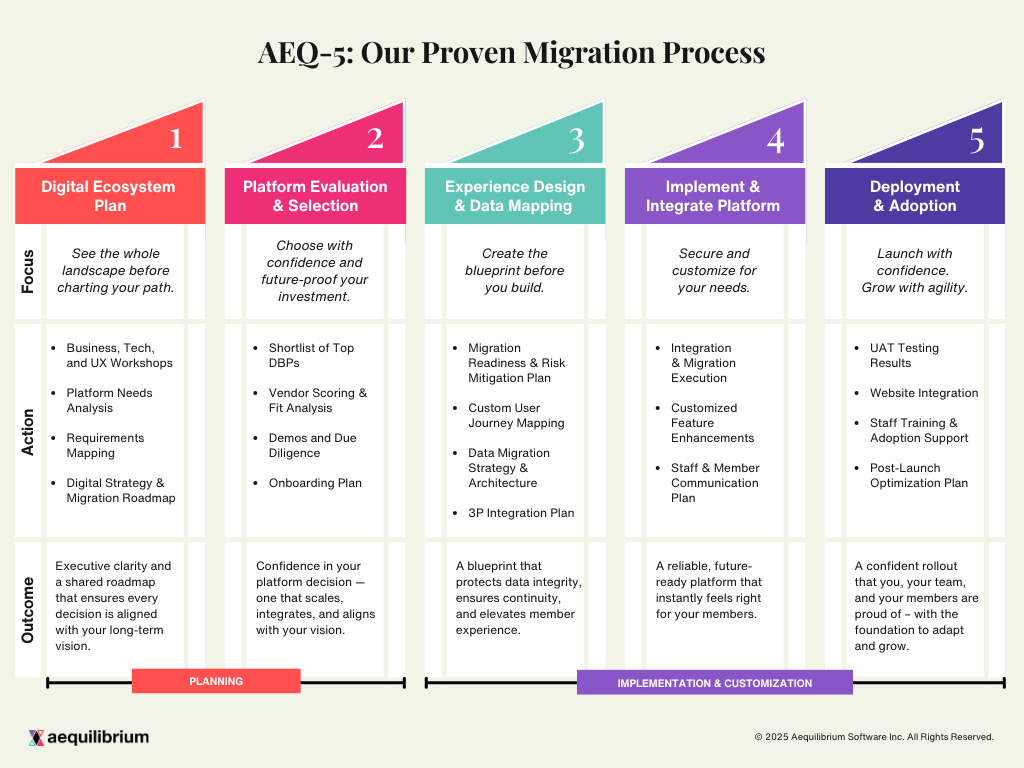

A Proven 5-Step Process for Digital Banking Migration

During our recent webinar, moderated by Henry Morato, Growth and Partnerships — AEQ’s leadership team introduced credit union leaders to our 5-Step Proven Process for Digital Banking Migration. This framework is designed to bring clarity, confidence, and alignment to one of the most critical choices any CU can make.

Whether you are assessing risks, selecting vendors, or preparing your teams for change, our process ensures decisions are made with foresight, collaboration, and member-first thinking.

AEQ-5: Our Proven Migration Process

Step 1: Digital Ecosystem Planning

Migration begins with strategy, not software. Before diving into platforms and vendors, credit unions need to build a clear picture of their digital ecosystem. This phase is about understanding where you are today and where you want to go tomorrow.

It starts with three key questions:

What systems and processes do we currently rely on?

Which member and staff journeys matter most for experience and efficiency?

What business outcomes are we ultimately trying to achieve?

Through the lens of AEQ’s leadership team, these questions take on sharper focus:

Business & Strategy – “Platform choices must align with long-term goals, not short-term fixes,” emphasized Adrian Moise, CEO.

Experience – Daniel Paz highlighted mapping current pain points and opportunities: “Transformation must translate into tangible improvements for members and staff.”

Technology – Baris Tuncertan underscored the need to identify dependencies in the current architecture, reducing risks during migration.

Governance & Delivery – Both Adrian and Baris reinforced that governance provides guardrails, ensuring early planning remains anchored in business priorities.

Key Takeaway: By starting with strategy and ecosystem clarity, credit unions create a roadmap where every future technology choice serves a clear purpose, driving both operational resilience and member value.

Adrian summed it up clearly: “Step one is about clarity. If you don’t establish your digital ecosystem plan up front, you risk making tactical decisions that don’t align with long-term strategy.”

Step 2: Platform Evaluation & Selection

Migration begins with strategy, not software. Before diving into platforms and vendors, credit unions need to build a clear picture of their digital ecosystem. This phase is about understanding where you are today and where you want to go tomorrow.

It starts with three key questions:

What systems and processes do we currently rely on?

Which member and staff journeys matter most for experience and efficiency?

What business outcomes are we ultimately trying to achieve?

Through the lens of AEQ’s leadership team, these questions take on sharper focus:

Business & Strategy – “Platform choices must align with long-term goals, not short-term fixes,” emphasized Adrian Moise, CEO.

Experience – Daniel Paz highlighted mapping current pain points and opportunities: “Transformation must translate into tangible improvements for members and staff.”

Technology – Baris Tuncertan underscored the need to identify dependencies in the current architecture, reducing risks during migration.

Governance & Delivery – Both Adrian and Baris reinforced that governance provides guardrails, ensuring early planning remains anchored in business priorities.

Key Takeaway: By starting with strategy and ecosystem clarity, credit unions create a roadmap where every future technology choice serves a clear purpose, driving both operational resilience and member value.

From strategy to selection. Once a clear vision is in place, the next step is choosing the right platform, a process that’s less about features and more about trade-offs.

Key question: What matters most to your credit union – cost, configurability, speed-to-market, or scalability?

What to Weigh

Cost & ROI – Will the platform deliver sustainable long-term value?

Configurability – Can it adapt to evolving member and staff needs?

Speed-to-Market – How quickly can new services be launched?

Scalability – Will the platform support growth and future innovation?

How AEQ Helps

Rather than relying on vendor marketing promises, AEQ helps credit unions weigh:

Business objectives

Member experience priorities

Technical realities

Governance requirements

Takeaway: The best platform isn’t the one with the longest checklist, it’s the one that aligns with your strategy, creates member trust, and positions your credit union for sustainable growth.

As Baris explained, “We apply structure, security, scalability, integration fit. It’s not about vendor slides; it’s about how platforms perform against real criteria.” Daniel added, “Members don’t judge by feature lists, they judge by how intuitive and seamless the experience feels.”

Step 3: Experience Design & Data Mapping

A platform isn’t just infrastructure, it’s the foundation for member trust and engagement. At this stage, the focus is on configuring the selected platform to deliver differentiated experiences, while ensuring data is structured to enable personalization and actionable insights.

How leaders framed it:

Adrian described this as “turning strategy into lived member journeys.”

Daniel emphasized the importance of prototyping and testing key flows before development, to validate assumptions and refine experiences early.

Baris highlighted the critical role of data governance and mapping, ensuring the platform can support both compliance and innovation.

Adrian and Baris together underscored the need for delivery discipline, so that experience design isn’t lost in translation during implementation.

Great platforms don’t just function, they feel intuitive, personalized, and reliable. Achieving that requires equal attention to design, data, and disciplined delivery.

Daniel put it simply: “Experience design is where the blueprint gets created. If we don’t map member pain points, the migration risks carrying over legacy frustrations into a shiny new platform.”

Step 4: Implement & Integrate Platform

This is often the riskiest stage of digital migration, the point where projects can stall under scope creep, budget overruns, or integration challenges. Success here depends on discipline.

At AEQ, implementation is guided by three anchors:

Keeping delivery tied to long-term strategic goals,

Ensuring usability for both members and staff remains front and center,

Validating integrations across critical systems such as core, CRM, and payments.

Strong governance reinforces these efforts through agile coaching, code reviews, and architecture oversight. The result is that implementation shifts from a fragile build phase into a controlled, measurable delivery of strategic intent.

Baris stressed: “Integration is the real work. Core, payments, CRM, analytics, websites—all must talk to each other.” Adrian added: “This is where governance is critical—otherwise tech drives the project instead of strategy.”

Step 5: Deployment & Adoption

Go-live is not the finish line, it’s the start of adoption. The value of a new platform is realized only when members trust it and staff weave it into their daily work.

Adrian stressed that adoption itself is the true measure of success. Daniel pointed to the importance of thoughtful onboarding and training experiences that minimize friction and build confidence. Baris emphasized monitoring stability and reliability to reinforce member trust. Adrian and Baris also reminded leaders that governance does not end at launch, it continues through measurement, ongoing support, and iterative improvement

As Adrian put it: “Success isn’t launch day. Success is adoption.” Daniel added: “Members shouldn’t notice the migration—they should just feel their credit union got better.”

Final Takeaways from the Panel

As the webinar closed, each panelist left credit union leaders with a core piece of advice:

- Adrian (Business/Strategy): “Think long-term. The platform you choose now sets your course for the next decade—make sure it aligns with your business vision.”

- Daniel (Experience): “Experience is the product. Members don’t judge by feature lists—they judge by how it feels to bank with you.”

- Baris (Technology): “Integration is where the risks lie. Get it right early, and you avoid years of painful rework.”

Adrian & Baris (Governance/Delivery): “Don’t underestimate delivery discipline. Agile, structured governance is what keeps migrations on time, on budget, and aligned to strategy.”

Ready to Take the Next Step?

If you’re a credit union leader navigating Forge migration, AEQ can help you cut through the noise with clear, unbiased guidance.

Missed the live session? You can watch the full webinar recording here: 5-STEP FRAMEWORK FOR DIGITAL BANKING MIGRATION

Reach out to us to discuss your digital banking journey and how AEQ’s 5-Step Proven Process can support your strategy. Because making the right platform choice isn’t just about today it’s about positioning your credit union to differentiate, grow, and deliver remarkable member experiences for the next decade.